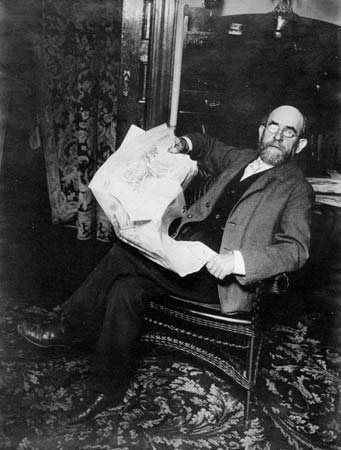

George, Henry

American economist

born Sept. 2, 1839, Philadelphia

died Oct. 29, 1897, New York City

land reformer and economist who in Progress and Poverty (1879) proposed the single tax: that the state tax away all economic rent—the income from the use of the bare land, but not from improvements—and abolish all other taxes.

land reformer and economist who in Progress and Poverty (1879) proposed the single tax: that the state tax away all economic rent—the income from the use of the bare land, but not from improvements—and abolish all other taxes.Leaving school before his 14th birthday, George worked for two years as a clerk in an importing house and then went to sea. Back in Philadelphia in 1856, he learned typesetting and in 1857 signed up as a steward on another ship, quitting it in San Francisco to join the gold rush in Canada, where, however, he arrived too late. In 1858 he returned to California, where he worked for newspapers and took part in Democratic Party politics until 1880. In 1871 he and two partners started the San Francisco Daily Evening Post, but credit difficulties forced them to close it in 1875. A political appointment as state gas-meter inspector enabled him to work on Progress and Poverty, which caught the spirit of discontent that had arisen from the economic depression of 1873–78. This popular book was translated into many languages. Its vogue was enhanced by George's pamphlets, his frequent contributions to magazines, and his lecture tours in both the United States and the British Isles.

As a basis for his argument, George gave new meaning to the orthodox, or “Ricardian” (after English economist David Ricardo (Ricardo, David)), doctrine of rent. He applied the law of diminishing returns and the concept of “margin of productivity” to land alone. He argued that since economic progress entailed a growing scarcity of land, the idle landowner reaped ever greater returns at the expense of the productive factors of labour and capital. This unearned economic rent, he held, should be taxed away by the state. George envisaged that the government's annual income from this “single tax” would be so large that there would be a surplus for expansion of public works. His economic argument was reinforced and dominated by humanitarian and religious appeal.

George's specific remedy had no significant practical result, and few economists of reputation supported it. Critics have observed that taxes on site values can reduce the incentive to make sites valuable, thereby weakening the intent of the tax. Nevertheless, George's forceful emphasis on “privilege,” his demand for equality of opportunity, and his systematic economic analysis proved a stimulus to orderly reform.

Additional Reading

R.A. Sawyer, Henry George and the Single Tax (1926); Anna George de Mille, Henry George, ed. by D.C. Shoemaker (1950); S.B. Cord, Henry George: Dreamer or Realist? (1965).

- Warren G. Harding: Inaugural Address

- Warren G. Harding: The Return to Normalcy

- Warren, Harry

- Warren Hastings

- Warren, Joseph

- Warren, J. Robin

- Warren, Leonard

- Warren, Mercy Otis

- Warren, Rick

- Warren, Robert Penn

- Warrensburg

- Warren Spahn

- Warren Wright

- Warri

- Warring States

- Warrington

- Warriston, Archibald Johnston, Lord

- Warrnambool

- Warrumbungle Range

- Warsaw

- Warsaw, Compact of

- Warsaw, Duchy of

- Warsaw Ghetto Uprising

- Warsaw Pact

- Warsaw Uprising